9 and Uzziah fathered Jotham, and Jotham fathered Ahaz, and Ahaz fathered Hezekiah, 10 and Hezekiah fathered Manasseh, and Manasseh fathered Amon, and Amon fathered Josiah, 11 and Josiah fathered Jechoniah and his brothers, at the time of the carrying away to Babylon. 12 And after the carrying away to Babylon, Jechoniah fathered Shealtiel. He came into his own city — Namely, Capernaum. And they brought him a man sick of the palsy — The history of this miracle is related Mark 2:1-13, and Luke 5:18-26, with more circumstances than are here mentioned by Matthew, which passages the reader is therefore desired to consult, for the further elucidation of what is here recorded.

The Markets

U.S. stocks rose Friday amid renewed optimism over another stimulus package because of talks between House Democrats and the Trump administration. The S&P and NASDAQ had their best week since early July; the Dow had its best weekly gain since August. For the week, the Dow rose 3.31 percent to close at 28,586.90. The S&P gained 3.89 percent to finish at 3,477.14, and the NASDAQ climbed 4.57 percent to end the week at 11,579.94.

Returns Through 10/09/20 | 1 Week | YTD | 1 Year | 3 Year | 5 Year |

Dow Jones Industrials (TR) | 3.31 | 11.12 | 10.45 | 13.58 | |

NASDAQ Composite (TR) | 4.57 | 29.99 | 47.92 | 21.99 | 20.43 |

S&P 500 (TR) | 3.89 | 9.22 | 21.39 | 13.16 | 13.81 |

Barclays US Agg Bond (TR) | -0.17 | 6.55 | 6.31 | 5.22 | 4.12 |

MSCI EAFE (TR) | 2.98 | -4.31 | 5.50 | 1.56 | 4.47 |

Source: Morningstar.com. *Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly. Three- and five-year returns are annualized. The Dow Jones Industrials, MSCI EAFE, Barclays US Agg Bond, NASDAQ and S&P, excluding '1 Week' returns, are based on total return, which is a reflection of return to an investor by reinvesting dividends after the deduction of withholding tax. (TR) indicates total return. MSCI EAFE returns stated in U.S. dollars.

The Living Commentary is the result of a call that the Lord placed on Andrew's life to be a teacher to the body of Christ. Along with that call came a God-given desire to help bring His body into 'the unity of the faith, and of the knowledge of the Son of God, unto a perfect man, unto the measure of the stature of fulness of Christ' (Eph. נסע nāsa‛ 'pluck out, break up, journey.' מקדם mı̂qedem 'eastward, or on the east side' as in Genesis 2:14; Genesis 13:11; Isaiah 9:11 (12). החלם hachı̂lām 'their beginning', for החלם hăchı̂lām, the regular form of this infinitive with a suffix.

Being Careful — Since the beginning of 2020, the size of the money market fund industry in the U.S. (both taxable and tax-free) has grown from $3.63 trillion as of Jan. 1 to $4.40 trillion as of Sept. 30, a YTD increase of $770 billion or $20 billion a week (source: Investment Company Institute, BTN Research).

Maybe Never — 31 percent of 1,018 American workers surveyed in January anticipate they will retire at age 70 or later (source: Employee Benefit Research Institute - 2020 Retirement Confidence Survey, BTN Research).

Simpler — As a result of the expansion in the size of the standard deduction that was part of the 2017 Tax Cuts and Jobs Act, only 10 percent of tax filers itemized in 2018, down from 30 percent in 2017 (source: Tax Foundation, BTN Research).

WEEKLY FOCUS – Medicare Open Enrollment

Medicare's annual open enrollment period begins October 15 and ends December 7. During this time, Medicare beneficiaries can change their drug plan or Advantage plan for the next calendar year. Supplemental Medigap plans, which have federally standardized benefits that don't change from year to year, are not included in the fall enrollment.

Medicare Advantage Plans: Medicare Advantage Plans replace Original Medicare with HMO- or PPO-like plans. Because these plans are allowed to refile with Medicare each year, benefits and premiums can change from year to year.

Adobe photoshop lightroom cc 2 1. Shortly before open enrollment begins, Advantage policy holders should receive an Annual Notice of Change (ANOC) from their provider. They should review the document carefully for changes to coverage, costs, or service area. Policy holders should also check to see if their preferred doctors, hospitals, pharmacies, or other providers are still in their plan. During Open Enrollment, beneficiaries may: change from Original Medicare (Parts A and B) to a Medicare Advantage plan or vice versa,* or switch to a different Medicare Advantage plan.

How to extract files on mac. Part D Plans: The company that provides a beneficiary's current drug coverage will also send an ANOC, so beneficiaries can ensure all their medications are still covered by the plan. During Open Enrollment, beneficiaries may switch to a different Part D plan or enroll in Part D if they didn't sign up during their general open enrollment period (a late enrollment fee may apply).

Also before Open Enrollment begins, insurers will provide an Evidence of Coverage (EOC), a comprehensive document explaining how the plan works and describing benefits, cost-sharing expenses, and what the plan pays. In addition to reviewing the ANOC or EOC, it is wise to compare other plans each year to see if another plan has become a better fit. The Medicare Plan Finder at medicare.gov/plan-compare/ is a convenient tool to use.

Health care decisions can be complicated. If you need help evaluating your options or determining how health care costs may impact your retirement, please call our office.

*NOTE: A beneficiary who drops an Advantage plan to return to Original Medicare may be subject to underwriting if they want to add a Medigap plan once they are past their original enrollment window or have been enrolled in Medicare Advantage for more than a year.

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America, Copyright October 2020. All rights reserved. Securities offered through Securities America, Inc., Member FINRA/SIPC. SAI# 3279700.1

The Markets

U.S. stocks rose Friday amid renewed optimism over another stimulus package because of talks between House Democrats and the Trump administration. The S&P and NASDAQ had their best week since early July; the Dow had its best weekly gain since August. For the week, the Dow rose 3.31 percent to close at 28,586.90. The S&P gained 3.89 percent to finish at 3,477.14, and the NASDAQ climbed 4.57 percent to end the week at 11,579.94.

Returns Through 10/09/20 | 1 Week | YTD | 1 Year | 3 Year | 5 Year |

Dow Jones Industrials (TR) | 3.31 | 2.02 | 11.12 | 10.45 | 13.58 |

NASDAQ Composite (TR) | 4.57 | 29.99 | 47.92 | 21.99 | 20.43 |

S&P 500 (TR) | 3.89 | 9.22 | 21.39 | 13.16 | 13.81 |

Barclays US Agg Bond (TR) | 6.55 | 6.31 | 5.22 | 4.12 | |

MSCI EAFE (TR) | 2.98 | -4.31 | 5.50 | 1.56 | 4.47 |

Source: Morningstar.com. *Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly. Three- and five-year returns are annualized. The Dow Jones Industrials, MSCI EAFE, Barclays US Agg Bond, NASDAQ and S&P, excluding '1 Week' returns, are based on total return, which is a reflection of return to an investor by reinvesting dividends after the deduction of withholding tax. (TR) indicates total return. MSCI EAFE returns stated in U.S. dollars.

Being Careful — Since the beginning of 2020, the size of the money market fund industry in the U.S. (both taxable and tax-free) has grown from $3.63 trillion as of Jan. 1 to $4.40 trillion as of Sept. 30, a YTD increase of $770 billion or $20 billion a week (source: Investment Company Institute, BTN Research).

Maybe Never — 31 percent of 1,018 American workers surveyed in January anticipate they will retire at age 70 or later (source: Employee Benefit Research Institute - 2020 Retirement Confidence Survey, BTN Research).

Simpler — As a result of the expansion in the size of the standard deduction that was part of the 2017 Tax Cuts and Jobs Act, only 10 percent of tax filers itemized in 2018, down from 30 percent in 2017 (source: Tax Foundation, BTN Research).

WEEKLY FOCUS – Medicare Open Enrollment

Medicare's annual open enrollment period begins October 15 and ends December 7. During this time, Medicare beneficiaries can change their drug plan or Advantage plan for the next calendar year. Supplemental Medigap plans, which have federally standardized benefits that don't change from year to year, are not included in the fall enrollment.

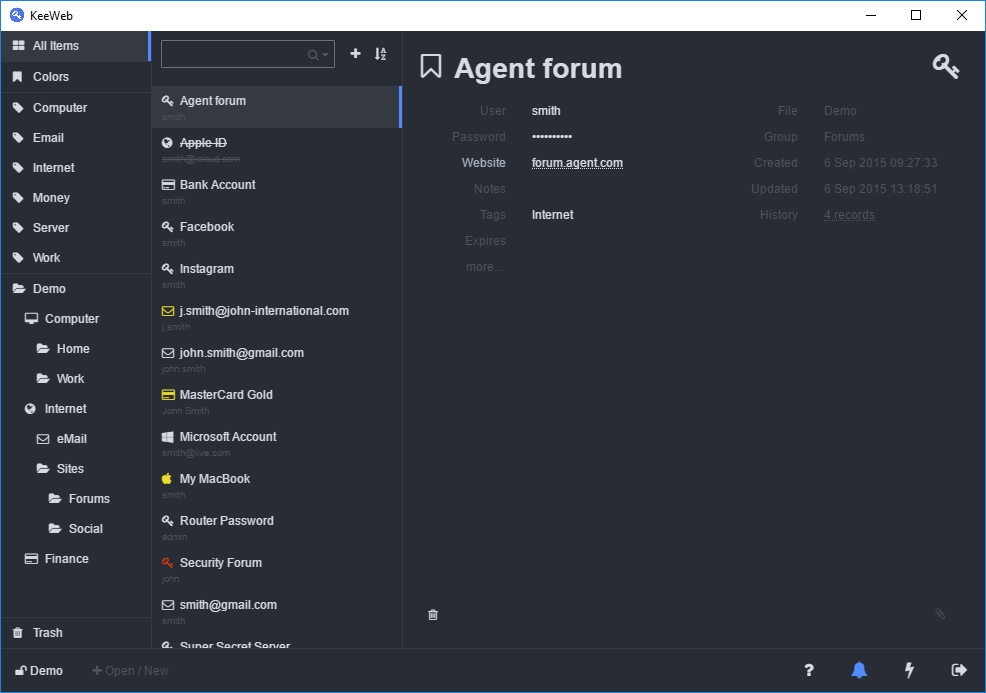

Keeweb 1 11 9 Commentary Matthew Henry

Medicare Advantage Plans: Medicare Advantage Plans replace Original Medicare with HMO- or PPO-like plans. Because these plans are allowed to refile with Medicare each year, benefits and premiums can change from year to year.

Shortly before open enrollment begins, Advantage policy holders should receive an Annual Notice of Change (ANOC) from their provider. They should review the document carefully for changes to coverage, costs, or service area. Policy holders should also check to see if their preferred doctors, hospitals, pharmacies, or other providers are still in their plan. During Open Enrollment, beneficiaries may: change from Original Medicare (Parts A and B) to a Medicare Advantage plan or vice versa,* or switch to a different Medicare Advantage plan.

Part D Plans: The company that provides a beneficiary's current drug coverage will also send an ANOC, so beneficiaries can ensure all their medications are still covered by the plan. During Open Enrollment, beneficiaries may switch to a different Part D plan or enroll in Part D if they didn't sign up during their general open enrollment period (a late enrollment fee may apply).

Also before Open Enrollment begins, insurers will provide an Evidence of Coverage (EOC), a comprehensive document explaining how the plan works and describing benefits, cost-sharing expenses, and what the plan pays. In addition to reviewing the ANOC or EOC, it is wise to compare other plans each year to see if another plan has become a better fit. The Medicare Plan Finder at medicare.gov/plan-compare/ is a convenient tool to use.

Health care decisions can be complicated. If you need help evaluating your options or determining how health care costs may impact your retirement, please call our office.

*NOTE: A beneficiary who drops an Advantage plan to return to Original Medicare may be subject to underwriting if they want to add a Medigap plan once they are past their original enrollment window or have been enrolled in Medicare Advantage for more than a year.

9 and Uzziah fathered Jotham, and Jotham fathered Ahaz, and Ahaz fathered Hezekiah, 10 and Hezekiah fathered Manasseh, and Manasseh fathered Amon, and Amon fathered Josiah, 11 and Josiah fathered Jechoniah and his brothers, at the time of the carrying away to Babylon. 12 And after the carrying away to Babylon, Jechoniah fathered Shealtiel. He came into his own city — Namely, Capernaum. And they brought him a man sick of the palsy — The history of this miracle is related Mark 2:1-13, and Luke 5:18-26, with more circumstances than are here mentioned by Matthew, which passages the reader is therefore desired to consult, for the further elucidation of what is here recorded.

The Markets

U.S. stocks rose Friday amid renewed optimism over another stimulus package because of talks between House Democrats and the Trump administration. The S&P and NASDAQ had their best week since early July; the Dow had its best weekly gain since August. For the week, the Dow rose 3.31 percent to close at 28,586.90. The S&P gained 3.89 percent to finish at 3,477.14, and the NASDAQ climbed 4.57 percent to end the week at 11,579.94.

Returns Through 10/09/20 | 1 Week | YTD | 1 Year | 3 Year | 5 Year |

Dow Jones Industrials (TR) | 3.31 | 11.12 | 10.45 | 13.58 | |

NASDAQ Composite (TR) | 4.57 | 29.99 | 47.92 | 21.99 | 20.43 |

S&P 500 (TR) | 3.89 | 9.22 | 21.39 | 13.16 | 13.81 |

Barclays US Agg Bond (TR) | -0.17 | 6.55 | 6.31 | 5.22 | 4.12 |

MSCI EAFE (TR) | 2.98 | -4.31 | 5.50 | 1.56 | 4.47 |

Source: Morningstar.com. *Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly. Three- and five-year returns are annualized. The Dow Jones Industrials, MSCI EAFE, Barclays US Agg Bond, NASDAQ and S&P, excluding '1 Week' returns, are based on total return, which is a reflection of return to an investor by reinvesting dividends after the deduction of withholding tax. (TR) indicates total return. MSCI EAFE returns stated in U.S. dollars.

The Living Commentary is the result of a call that the Lord placed on Andrew's life to be a teacher to the body of Christ. Along with that call came a God-given desire to help bring His body into 'the unity of the faith, and of the knowledge of the Son of God, unto a perfect man, unto the measure of the stature of fulness of Christ' (Eph. נסע nāsa‛ 'pluck out, break up, journey.' מקדם mı̂qedem 'eastward, or on the east side' as in Genesis 2:14; Genesis 13:11; Isaiah 9:11 (12). החלם hachı̂lām 'their beginning', for החלם hăchı̂lām, the regular form of this infinitive with a suffix.

Being Careful — Since the beginning of 2020, the size of the money market fund industry in the U.S. (both taxable and tax-free) has grown from $3.63 trillion as of Jan. 1 to $4.40 trillion as of Sept. 30, a YTD increase of $770 billion or $20 billion a week (source: Investment Company Institute, BTN Research).

Maybe Never — 31 percent of 1,018 American workers surveyed in January anticipate they will retire at age 70 or later (source: Employee Benefit Research Institute - 2020 Retirement Confidence Survey, BTN Research).

Simpler — As a result of the expansion in the size of the standard deduction that was part of the 2017 Tax Cuts and Jobs Act, only 10 percent of tax filers itemized in 2018, down from 30 percent in 2017 (source: Tax Foundation, BTN Research).

WEEKLY FOCUS – Medicare Open Enrollment

Medicare's annual open enrollment period begins October 15 and ends December 7. During this time, Medicare beneficiaries can change their drug plan or Advantage plan for the next calendar year. Supplemental Medigap plans, which have federally standardized benefits that don't change from year to year, are not included in the fall enrollment.

Medicare Advantage Plans: Medicare Advantage Plans replace Original Medicare with HMO- or PPO-like plans. Because these plans are allowed to refile with Medicare each year, benefits and premiums can change from year to year.

Adobe photoshop lightroom cc 2 1. Shortly before open enrollment begins, Advantage policy holders should receive an Annual Notice of Change (ANOC) from their provider. They should review the document carefully for changes to coverage, costs, or service area. Policy holders should also check to see if their preferred doctors, hospitals, pharmacies, or other providers are still in their plan. During Open Enrollment, beneficiaries may: change from Original Medicare (Parts A and B) to a Medicare Advantage plan or vice versa,* or switch to a different Medicare Advantage plan.

How to extract files on mac. Part D Plans: The company that provides a beneficiary's current drug coverage will also send an ANOC, so beneficiaries can ensure all their medications are still covered by the plan. During Open Enrollment, beneficiaries may switch to a different Part D plan or enroll in Part D if they didn't sign up during their general open enrollment period (a late enrollment fee may apply).

Also before Open Enrollment begins, insurers will provide an Evidence of Coverage (EOC), a comprehensive document explaining how the plan works and describing benefits, cost-sharing expenses, and what the plan pays. In addition to reviewing the ANOC or EOC, it is wise to compare other plans each year to see if another plan has become a better fit. The Medicare Plan Finder at medicare.gov/plan-compare/ is a convenient tool to use.

Health care decisions can be complicated. If you need help evaluating your options or determining how health care costs may impact your retirement, please call our office.

*NOTE: A beneficiary who drops an Advantage plan to return to Original Medicare may be subject to underwriting if they want to add a Medigap plan once they are past their original enrollment window or have been enrolled in Medicare Advantage for more than a year.

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America, Copyright October 2020. All rights reserved. Securities offered through Securities America, Inc., Member FINRA/SIPC. SAI# 3279700.1

The Markets

U.S. stocks rose Friday amid renewed optimism over another stimulus package because of talks between House Democrats and the Trump administration. The S&P and NASDAQ had their best week since early July; the Dow had its best weekly gain since August. For the week, the Dow rose 3.31 percent to close at 28,586.90. The S&P gained 3.89 percent to finish at 3,477.14, and the NASDAQ climbed 4.57 percent to end the week at 11,579.94.

Returns Through 10/09/20 | 1 Week | YTD | 1 Year | 3 Year | 5 Year |

Dow Jones Industrials (TR) | 3.31 | 2.02 | 11.12 | 10.45 | 13.58 |

NASDAQ Composite (TR) | 4.57 | 29.99 | 47.92 | 21.99 | 20.43 |

S&P 500 (TR) | 3.89 | 9.22 | 21.39 | 13.16 | 13.81 |

Barclays US Agg Bond (TR) | 6.55 | 6.31 | 5.22 | 4.12 | |

MSCI EAFE (TR) | 2.98 | -4.31 | 5.50 | 1.56 | 4.47 |

Source: Morningstar.com. *Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly. Three- and five-year returns are annualized. The Dow Jones Industrials, MSCI EAFE, Barclays US Agg Bond, NASDAQ and S&P, excluding '1 Week' returns, are based on total return, which is a reflection of return to an investor by reinvesting dividends after the deduction of withholding tax. (TR) indicates total return. MSCI EAFE returns stated in U.S. dollars.

Being Careful — Since the beginning of 2020, the size of the money market fund industry in the U.S. (both taxable and tax-free) has grown from $3.63 trillion as of Jan. 1 to $4.40 trillion as of Sept. 30, a YTD increase of $770 billion or $20 billion a week (source: Investment Company Institute, BTN Research).

Maybe Never — 31 percent of 1,018 American workers surveyed in January anticipate they will retire at age 70 or later (source: Employee Benefit Research Institute - 2020 Retirement Confidence Survey, BTN Research).

Simpler — As a result of the expansion in the size of the standard deduction that was part of the 2017 Tax Cuts and Jobs Act, only 10 percent of tax filers itemized in 2018, down from 30 percent in 2017 (source: Tax Foundation, BTN Research).

WEEKLY FOCUS – Medicare Open Enrollment

Medicare's annual open enrollment period begins October 15 and ends December 7. During this time, Medicare beneficiaries can change their drug plan or Advantage plan for the next calendar year. Supplemental Medigap plans, which have federally standardized benefits that don't change from year to year, are not included in the fall enrollment.

Keeweb 1 11 9 Commentary Matthew Henry

Medicare Advantage Plans: Medicare Advantage Plans replace Original Medicare with HMO- or PPO-like plans. Because these plans are allowed to refile with Medicare each year, benefits and premiums can change from year to year.

Shortly before open enrollment begins, Advantage policy holders should receive an Annual Notice of Change (ANOC) from their provider. They should review the document carefully for changes to coverage, costs, or service area. Policy holders should also check to see if their preferred doctors, hospitals, pharmacies, or other providers are still in their plan. During Open Enrollment, beneficiaries may: change from Original Medicare (Parts A and B) to a Medicare Advantage plan or vice versa,* or switch to a different Medicare Advantage plan.

Part D Plans: The company that provides a beneficiary's current drug coverage will also send an ANOC, so beneficiaries can ensure all their medications are still covered by the plan. During Open Enrollment, beneficiaries may switch to a different Part D plan or enroll in Part D if they didn't sign up during their general open enrollment period (a late enrollment fee may apply).

Also before Open Enrollment begins, insurers will provide an Evidence of Coverage (EOC), a comprehensive document explaining how the plan works and describing benefits, cost-sharing expenses, and what the plan pays. In addition to reviewing the ANOC or EOC, it is wise to compare other plans each year to see if another plan has become a better fit. The Medicare Plan Finder at medicare.gov/plan-compare/ is a convenient tool to use.

Health care decisions can be complicated. If you need help evaluating your options or determining how health care costs may impact your retirement, please call our office.

*NOTE: A beneficiary who drops an Advantage plan to return to Original Medicare may be subject to underwriting if they want to add a Medigap plan once they are past their original enrollment window or have been enrolled in Medicare Advantage for more than a year.

Keeweb 1 11 9 Commentary Kjv

*The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America, Copyright October 2020. All rights reserved. Securities offered through Securities America, Inc., Member FINRA/SIPC. Lossless converter for itunes 1 7 0 8. SAI# 3279700.1